OneStream Wins Our Innovation Award in Office of Finance with Analytic Blend

Written by

Robert Kugel

Aug 31, 2020 10:46:27 AM

One of the challenges of being a practically minded technology analyst is squaring the importance of “the next big thing” with the reality of what most organizations are doing. For decades it’s been the case that “the next big thing” in the world of information technology is easily several years ahead of where most  organizations are in their use of technology. And before most organizations can realize the benefit of some whiz-bang technology, they frequently need to address a range of more mundane issues, such as data availability and accuracy, employee training and corporate culture, among other impediments. Sometimes, though, advanced technology works to uncomplicate things for organizations.

organizations are in their use of technology. And before most organizations can realize the benefit of some whiz-bang technology, they frequently need to address a range of more mundane issues, such as data availability and accuracy, employee training and corporate culture, among other impediments. Sometimes, though, advanced technology works to uncomplicate things for organizations.

For this reason, Ventana Research gave OneStream Software its 2020 Innovation Award for its Analytic Blend software. This tool, which became available in the Fall 2019 release, can address increasingly critical requirements for the Office of Finance and do so at scale. Analytic Blend provides a governed set of analytical functionality including financial consolidation, transactional analysis and data aggregation. It supports a range of capabilities from a single platform, including financial analytics, business intelligence, planning and budgeting as well as ad-hoc and periodic reporting. It's "governed" in the sense that organizations can control access to data with defined permissions and can define workflows to ensure consistent and timely execution of steps in a process, including reviews and approvals.

Analytic Blend can assemble a wide spectrum of data from financial and operational data sources without latency for analysis, alerting and reporting. In doing so, it can expand the frontiers of visibility and enable finance departments to provide action-oriented insights to executives and managers. So, as a practical matter, how does this affect the mission of the FP&A organization?

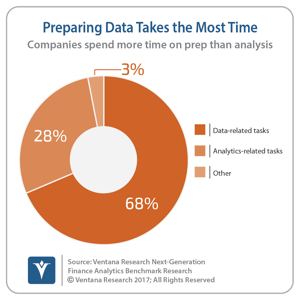

Almost a decade ago I wrote a research note, Putting the “A” Back in FP&A (Financial Planning and Analysis). My main point was that the mechanical processes of pulling together, collating and checking data takes up so much time that there’s too little time for analysis. Our more recent Finance Analytics benchmark research underscores the persistence of this problem.  More than two-thirds (68%) of organizations report spending the bulk of their time on data-related tasks while only 28% said they spend most of their time doing what they’re paid to do: analyze.

More than two-thirds (68%) of organizations report spending the bulk of their time on data-related tasks while only 28% said they spend most of their time doing what they’re paid to do: analyze.

Analytic Blend addresses this issue by offering an authoritative, consistent, complete and secure source of timely data for analysis and reporting. The data is authoritative because it’s sourced directly from systems of record. It’s consistent because the data represented is up-to-date and all users of the data are relying on a single source. It’s complete because it breaks down information silos to include operational and financial information. It’s secure because all of the permissions that govern the source system are applied to Analytic Blend, so sensitive information is only available to those allowed to view it. It’s timely because there are no long lags caused by manual or batch-type of data movements. If this sounds simple, it isn’t. The award reflects our appreciation for how this sophisticated technology can simplify important work.

Beyond improving the efficiency of data preparation for the FP&A organization, Analytic Blend makes it possible for analysts to work with a far broader palette of information than accounting data. Historically, financial data has had primacy in measuring performance because it’s been the easiest to access, aggregate and analyze. While financial performance is important, it’s a one-dimensional view of how well an organization is functioning. Having operational data within easy reach enables FP&A groups to make this information more widely available and to incorporate it into more insightful reporting. This might include input-output types of analyses to assess the relative efficiency or effectiveness of an operating unit over time or to compare the performance of multiple business units, for instance, revenue per employee hour by location or total kilowatt hours consumed per unit of output. Finance organizations that want to play a more strategic role in their organization must be able to synthesize financial and operational information to provide executives and managers with useful, balanced and timely performance measures.

A single data source like Analytic Blend also facilitates the development of predictive and prescriptive analytics — not just what happened and why but what’s likely to happen and what can be done to achieve a more desirable result. A single data source also makes it easier to apply artificial intelligence through machine learning to facilitate business forecasting planning and budgeting and to use those predictions to quickly spot anomalies and provide alerts to responsible parties when results deviate from expectations. This means rather than waiting until the end of the month or quarter to take action, organizations can quickly exploit opportunities or mitigate damage in time to improve performance. Analytic Blend is an effective platform for what I call profitability management, a cross-functional effort. It integrates finance and sales to achieve an optimal balance of revenue and margin objectives. Moreover, a single data source makes more effective reporting much easier to realize, the type of reporting that I recently outlined for improving visibility, transparency and perspective.

The recent economic and market ructions have forced organizations to rethink how they budget and plan to achieve resiliency. They may have found it difficult to close their books and are looking to replace an aging consolidation system or acquire one to facilitate and speed up their accounting close. I recommend that companies that are considering planning and budgeting software or a consolidation system include OneStream in their evaluation. In particular, they should consider the significant dividend that OneStream can provide with Analytic Blend.

Regards

Robert Kugel

Robert Kugel

Executive Director, Business Research

Robert Kugel leads business software research for ISG Software Research. His team covers technology and applications spanning front- and back-office enterprise functions, and he runs the Office of Finance area of expertise. Rob is a CFA charter holder and a published author and thought leader on integrated business planning (IBP).