Revenue Performance Management

In many organizations, the sales department is being superseded by revenue teams supporting within the organization, a super-set of traditional sales functions that includes not only those involved in gaining new customers, but also those with an increased focus on customer retention, expansion and cross-sell aimed at existing customers. In addition, as organizations embrace additional sales channels, whether through more typical indirect sales through partners or via new digital selling channels like e-commerce, revenue management will require an enhanced degree of alignment and coordination. The economics of multichannel selling and newer business models require the need to expand focus and resources beyond new business. This will impact not just sales teams but also marketing, partner management and customer service.

To achieve these aims, leadership and planning will be key. Any time an organization transitions to new organizational approaches and processes, there will be resistance, missteps and potential disruption. A change in the approach of strategic leadership, and in the planning, monitoring and real-time adjustments via sales or revenue operation teams is essential. Revenue-driven organizations must manage operations with performance demands in mind and ensure consistent results every quarter, month in and month out. Revenue leaders need to implement processes that support overall strategy and growth, and also optimize both sales professional talent and the selling experience needed to achieve expectations.

The next generation of revenue and sales leaders are embracing the need to focus on creating processes that generate and project predictable revenues. Revenue Performance Management (RPM) is a coordinated set of revenue-generating and related activities, processes, and systems that enable organizations to plan, execute, monitor and adjust in real time to achieve customer, product and revenue targets. The imperative to maximize outcomes from all channels and departments of revenue faces many challenges in every organization. Key revenue responsibilities across departments that generate new business and client relationships, retain existing ones through potential subscription renewals or upselling, and expand into existing customers are all about setting up revenue efforts in an effective manner. Territories that are balanced, quota and compensation that are aligned with corporate objectives, and reliable forecasts are key to achieving overall goals and outcomes.

In addition, new initiatives from technology vendors that use artificial intelligence (AI) and machine learning (ML) that apply to historic data can create new insights to inform both management and revenue-focused professionals. The use of AI can be applied in a variety of different ways, from individual deal scoring to overall pipeline health, customer churn risk prediction and identifying upsell and cross-sell opportunities for existing customers, as well as next best action recommendations. All this information can be used to inform revenue forecasts with a greater degree of accuracy and predictability than traditional bottom-up judgement forecasting on its own. And in response to the increased pressure to retain revenue talent, it can be used both to improve individual and teams’ abilities to succeed and to highlight those at risk of leaving.

Ensuring that all buying and selling channels and departments contribute as fully as possible to the success of the organization — to retention, growth, profitability, and the overall customer experience — requires not only dedication but effective strategy and planning. A well-developed strategy and plan to utilize current and future talent for sales and revenue efforts are essential for the best possible performance. To carry out this mission, organizations need a set of coordinated revenue-related activities, processes and systems that enable the sales organization, from leadership and operations to the manager and sellers and customer success, to operate in a coordinated and collaborative manner. The evolution to RPM enables the ability to maximize outcomes across buying or sales channels.

The evolution to RPM enables the ability to maximize outcomes across buying or sales channels.

Sales and revenue teams are designed to deliver the most effective return on an organization’s products and services across customers or consumers and must ensure that selling is done efficiently and intelligently. Sales and revenue channels and departments are typically complex entities, often with cultures and historical approaches that can inadvertently sabotage their performance. And many in leadership believe that sales efforts can adapt and change its behavior without seeking out and using best practices.

In our view, effective management across sales and revenue operations requires well-designed and continuously optimized territories and accounts aligned with quotas that are designed to achieve an organization’s full revenue potential. Territories can be based not only on geographies but on a variety of alternate drivers leading to virtual territories more aligned with current needs. Quotas need to be linked to both overall organization objectives and product and service category targets. With the advent of self-service and digital channels, and as customers can engage across multiple channels for a single purchase, both quotas and territories need to ensure individuals are not penalized or disincentivized. This foundation must be established through modeling and planning that will provide the analytics and metrics necessary to guide revenue leadership and operations for the coming month, quarter, year and beyond. To remain flexible and responsive to market conditions, organizations should employ the concept of continuous revenue performance monitoring and adjust based on data-driven insights and forecasts rather than a whim and gut feeling.

To remain flexible and responsive to market conditions, organizations should employ the concept of continuous revenue performance monitoring.

Use of analytics and data from operations and planning can assist in revenue-related compensation plans that utilize commissions and incentives to influence and align behavior and priorities. To optimize revenue performance, organizations thus must be able to design and apply incentives that motivate those supporting revenue generation to reach their targets. To evaluate whether compensation plans, and incentives are effective, revenue leadership needs tools to help assess the relationship between plans, targets, and actual performance. Comparing compensation and incentive plans among all revenue personnel and with other parts of the organization, for example, can help managers determine whether what they provide is appropriate. Goals and objectives must be defined, established, tracked, and then linked to incentives and rewards to help guide revenue performance. Moreover, organizations need to know whether their compensation is competitive in their market. Using benchmarks to compare compensation to that of others in the industry can provide this information.

Using spreadsheets to manage revenue operations and performance is ineffective and can be problematic when trying to achieve optimal outcomes. Spreadsheets are not designed for managing the data needed across revenue channels or the varying types of buying and selling channels that must be measured toward goals and targets. Spreadsheets also cannot scale as a company grows. The use of multiple spreadsheets, often stored on users’ local drives, is a factor in producing scattered information, which the majority of organizations cite as a major impediment to managing revenue performance. A dedicated approached to RPM can provide a better method to achieve an organization’s goals.

Using spreadsheets to manage revenue operations and performance is ineffective and can be problematic to achieving optimal outcomes.

Even revenue-related applications such as sales force automation (SFA) and customer relationship management (CRM) that are designed to capture data about accounts, contacts and opportunities cannot deliver optimal visibility into overall revenue performance in the way that a dedicated RPM system can. Dashboards and reports from SFA systems typically look only at historical performance, but backward-looking reports can’t provide timely guidance on the current state of quotas and incentives for sales professionals and are not flexible enough to provide information on or credit others involved in deals.

Ventana Research has over almost two decades conducted market research in a spectrum of related areas including revenue and sales performance management as well as broader areas ranging from SFA and CRM to sales and revenue analytics and planning supporting revenue intelligence and operations.

The Value Index for Revenue Performance Management uses the Ventana Research methodology, a framework that evaluates application vendors and their products in seven categories of requirements. Five are product-related, assessing usability, manageability, reliability, capability, and adaptability, while two quantify the customer assurance issues of vendor validation and total cost of ownership and return on investment (TCO/ROI).

This Value Index report evaluates the following vendors that offer products that deliver revenue performance management as we define it: Anaplan, beqom, Board International, Clari, Gong.io, InsightSquared (acquired by MediaFly), Salesforce, SAP, Oracle, SugarCRM, Varicent Software Inc. and Xactly.

We urge organizations to be thorough in evaluating vendors that support RPM and offer this Value Index as both the results of our in-depth analysis of these vendors and as an evaluation methodology. The Value Index can be used to evaluate existing suppliers and provides evaluation criteria for new projects; applying it can shorten the cycle time for an RFP.

We urge organizations to be thorough in evaluating vendors that support revenue performance management.

Unlike many IT analyst firms that rank vendors from a product feature perspective or consider futures or vision over what is available in the products today, Ventana Research has designed the Value Index to provide a balanced perspective of vendors and products that is rooted in an understanding of how products should be assessed, evaluated and selected, and how the products are utilized across roles and must be adapted and managed to meet the business requirements. This approach not only reduces cost and time but also minimizes the risk of making a decision that is bad for the organization. Using the Value Index will enable your organization to achieve the levels of efficiency and effectiveness needed to support RPM.

Value Index Overview

For almost two decades, Ventana Research has conducted market research in a portfolio of business and technology areas. We have also led the establishment of RPM as the successor to sales performance management (SPM). The findings of these research undertakings contribute to our comprehensive approach.

This market research report, the Ventana Research Revenue Performance Management Value Index is the distillation of over a year of market and product research efforts by Ventana Research. It is an assessment of how well vendors’ offerings will address buyers’ requirements for RPM software. The index is structured to replicate an RFI/RFP process by incorporating all criteria needed to evaluate, select, utilize, and maintain technology, and maintain relationships with vendors.

Ventana Research has designed the Value Index to provide a balanced perspective of vendors and products that is rooted in an understanding of business drivers and needs.

In this Value Index, Ventana Research evaluates the software in seven key categories that are weighted to reflect buyers’ needs based on our expertise and research. Five are product-experience related: Adaptability, Capability, Manageability, Reliability, and Usability. In addition, we consider two customer-experience categories: Vendor Validation, and Total Cost of Ownership and Return on Investment (TCO/ROI). To assess functionality, one of the components of capability, we applied the Ventana Research Value Index methodology and blueprint, which links the personas and processes for RPM to an organization’s requirements.

Unlike many IT analyst firms that rank vendors from an IT-only perspective or consider futures or vision over what is available in the products today, Ventana Research has designed the Value Index to provide a balanced perspective of vendors and products that is rooted in an understanding of business drivers and needs. This approach not only reduces cost and time but also minimizes the risk of making a decision that is bad for an organization. Using the Value Index will enable your organization to use RPM to achieve the levels of organizational efficiency and effectiveness needed for engaging digital experiences to meet your buyer, consumer, customer, and partner needs.

We use our research-based methodology to generate the Value Index ratings. We then build them into a set of indicators that we present in both analytic and visual form, each depicting the value of each vendor’s offering in RPM.

The Value Index is not an abstraction; we use a carefully crafted best practices-based methodology to represent how organizations assess vendors and products.

The Value Index is not an abstraction; we use a carefully crafted best practices-based methodology to represent how organizations assess vendors and products. The Value Index is designed to ensure that it provides objective research and guidance to organizations looking to assess and evaluate their applications for business and IT needs.

The structure of the Value Index reflects our understanding that the effective evaluation of vendors and products involves far more than just examining features, revenue generated or number of customers. We believe it is important to take this comprehensive research-based approach, since making the wrong choice can increase the total cost of ownership, lower the return on investment and hamper an organization’s ability to reach its performance potential. In addition, this approach can reduce the project’s development and deployment time and eliminate the risk of relying on a short list of vendors that does not represent a best fit for your organization.

To ensure the accuracy of the information we collected, we asked participating vendors to provide product and company information across the seven categories that taken together reflect the concerns of a well-crafted RFP. Ventana Research then validated the information, first independently through our database of product information and extensive web-based research, and then in consultation with the vendors. Most selected vendors also participated in one-on-one consultative sessions, after which we requested them to provide additional documentation to support any new input.

Ventana Research believes that an objective review of vendors and products is a critical business strategy for the adoption and implementation of RPM software and applications. An organization’s review should include a thorough analysis of both what is possible and what is relevant. We urge organizations to do a thorough job of evaluating RPM systems and tools and offer this Value Index as both the results of our in-depth analysis of these vendors and as an evaluation methodology.

How To Use This Value Index

Evaluating Vendors: The Process

In our view, business improvement efforts should be based on best practices that research indicates deliver value quickly. Our Value Index evaluates RPM business systems and tools in accordance with that belief.

We advocate using the Value Index as part of a structured approach that begins by incorporating these steps into a program document that will both summarize and detail your initiative or project. Then consult the Value Index to ensure you make choices that will yield the results you want.

The steps listed below provide a framework for a technology-driven business improvement project.

- Define the business case and goals.

Develop the business case for investment. Define the mission of the business project: What is the purpose, why is it important, what outcome do you want to achieve and how will you measure the project’s success? The goals should be grounded in your organization’s strategy and plans and should make clear the expected outcomes. - Specify the project’s business requirements.

What must be done to achieve these goals? Defining the business requirements helps identify what specific capabilities are required with respect to people, processes, information, and technology. - Assess the required roles and responsibilities.

Identify the individuals required for the project at every level of the organization from executives to front line workers and determine what each will contribute. - Outline the project’s critical path.

What needs to be done, in what order and who will do it? This outline should make clear the prior dependencies at each step of the project plan. - Develop the technology approach.

Determine the technology approach that most closely aligns to your organization’s requirements. Then develop a comprehensive list of potential vendors and products that best fit your needs. - Establish technology evaluation criteria.

Define the business and technology criteria that you will use to evaluate vendors. We recommend using the criteria we have developed based on our Benchmark Research and use to build the Value Index: Adaptability, Capability, Manageability, Reliability, TCO/ROI, Usability and Validation. This step will provide the tools necessary to move from a long list to a short list of vendors and products that you will then evaluate for final selection. - Evaluate and select the technology properly.

Weight the seven categories of technology evaluation criteria to reflect the organization’s priorities. Then evaluate the short list of vendors and products based on your business case, requirements, and the technology evaluation criteria for your project. - Establish the business initiative team to start the project.

Identify who will lead the project and the members of the team needed to plan and execute it. Have them begin by establishing a timeline and allocating resources.

In addition to evaluating existing suppliers, the Value Index can be used to provide evaluation criteria for new projects. Applying our research can shorten the cycle time when creating an RFP.

Products Evaluated

Vendor |

Product Names |

Version |

Release Month |

Release Year |

Anaplan

|

The Anaplan Platform |

- |

November |

2021 |

beqom

|

beqom Sales Performance Management |

- |

- |

2021 |

Board International

|

Board |

Summer Release |

- |

2021 |

Clari

|

Clari Revenue Operations Platform |

- |

- |

2021 |

Gong.io |

Gong |

- |

- |

2021 |

InsightSquared

|

InsightSquared Revenue Intelligence Platform |

- |

- |

2021 |

Oracle

|

Oracle Sales, Oracle Sales Planning Cloud |

21C |

August |

2021 |

Salesforce

|

Sales Cloud, Revenue Cloud, Customer 360 |

Winter ‘22 |

October |

2021 |

SAP

|

SAP Sales Cloud, SAP SuccessFactors |

- |

- |

2021 |

SugarCRM

|

Sugar Sell |

- |

- |

2021 |

Varicent

|

Varicent Incentive Compensation Management, Varicent Territory and Quota Planning, Varicent Lift, Symon.AI, Varicent Revenue Intelligence Workbench |

Version 10 |

- |

2021 |

Xactly

|

Xactly Platform, Xactly Incent |

- |

- |

2021 |

The Findings

All the products we evaluated are feature-rich, but not all the capabilities they offer are equally valuable to organizations or support everything needed across the entire lifecycle of use. Moreover, the existence of too many capabilities may be a negative factor for an organization if it introduces unnecessary complexity. Nonetheless, you may decide that a larger number of functions is a plus, especially if some of them match your organization’s established practices or support an initiative that is driving the purchase of new software.

Factors beyond features and functions or vendor assessments may become a deciding factor. For example, an organization may face budget constraints such that the TCO evaluation can tip the balance to one vendor or another. This is where the Value Index methodology and the appropriate category weighting can be applied to determine the best fit of vendors and products to your specific needs.

Overall Scoring of Vendors Across Categories

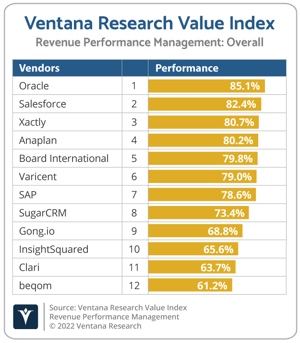

The Value Index for Revenue Performance Management in 2022 finds Oracle first overall with Salesforce in second place and Xactly in third. Companies that place in the top three in any category earn the designation Value Index Leader. Oracle has done so in six of the seven categories; Salesforce in five, Anaplan and Xactly in three, Board International in two, and SAP and Varicent in one category.

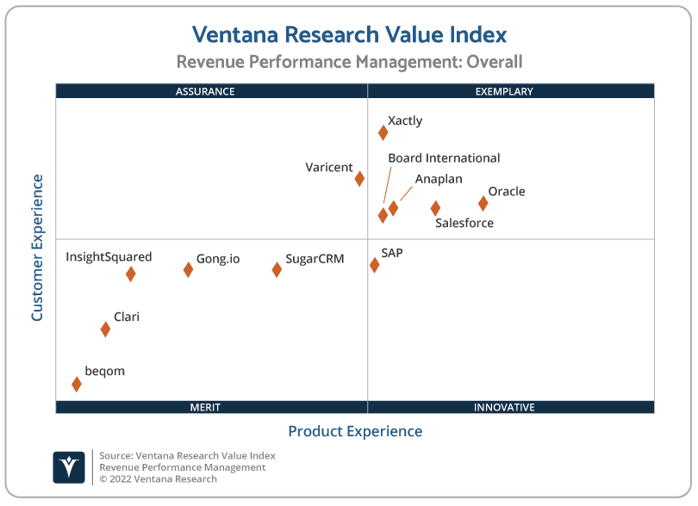

The overall representation of the Value Index below places the rating of the Product Experience and Customer Experience on the x and y axes, respectively, to provide a visual representation and classification of the vendors. Those vendors whose Product Experience have a higher weighted performance to the axis in aggregate of the five product categories place farther to the right, while the performance and weighting for the two Customer Experience categories determines their placement on the vertical axis. In short, vendors that place closer to the upper-right on this chart performed better than those closer to the lower-left.

Experience and Customer Experience on the x and y axes, respectively, to provide a visual representation and classification of the vendors. Those vendors whose Product Experience have a higher weighted performance to the axis in aggregate of the five product categories place farther to the right, while the performance and weighting for the two Customer Experience categories determines their placement on the vertical axis. In short, vendors that place closer to the upper-right on this chart performed better than those closer to the lower-left.

The research places vendors into one of four overall categories: Assurance, Exemplary, Merit or Innovative. This representation classifies vendors weighted performance overall in Product Experience and Customer Experience.

Exemplary: The categorization and placement of vendors in Exemplary (upper right) represent those that performed the best in meeting the overall Product and Customer Experience requirements. The vendors awarded Exemplary are Anaplan, Board International, Oracle, Salesforce and Xactly.

Innovative: The categorization and placement of vendors in Innovative (lower right) represent those that performed the best in meeting the overall Product Experience requirements but did not achieve the highest levels of requirements in Customer Experience. The vendor awarded Innovative is SAP.

Assurance: The categorization and placement of vendors in Assurance (upper left) represent those that achieved the highest levels in the overall Customer Experience requirements but did not achieve the highest levels of Product Experience. The vendor awarded Assurance is Varicent.

Merit: The categorization for vendors in Merit (lower left) represent those that did not exceed the median of performance in Customer or Product Experience or surpass the threshold for the other three categories. The vendors awarded Merit are: beqom, Clari, Gong.io, InsightSquared and SugarCRM.

We warn that close vendor placement should not be taken to imply that the packages evaluated are functionally identical or equally well suited for use by every organization or for a specific process. Although there is a high degree of commonality in how organizations support RPM, there are many idiosyncrasies and differences in how they do these functions that can make one vendor’s offering a better fit than another’s for a particular organization’s needs.

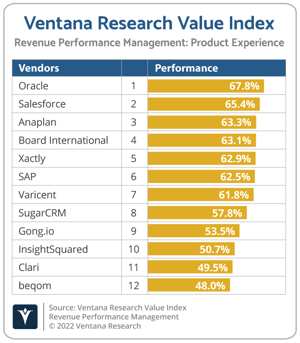

Product Experience

The process of researching products to address an organization’s needs should be comprehensive. Our Value Index methodology examines Product Experience and how it aligns with an organization’s lifecycle of onboarding, configuration, operations, usage and maintenance. Too often vendors are not evaluated for the entirety of the products; instead, they are evaluated on market execution and vision of the future, which are flawed since they do not represent an organization’s requirements but how the vendor operates. As more vendors establish a Chief Products Officer role, it is essential for them to be more engaged in the experience that their products represent.

The RPM Value Index based on the methodology of expertise and research identified the weighting of Product Experience to 80% or four-fifths of the total evaluation. Importance was placed on the categories as follows: Usability (20%), Capability (20%), Reliability (15%), Adaptability (10%) and Manageability (15%). This weighting impacted vendor rankings in Product Experience and the resulting overall rankings in this Value Index. The ranking of the vendors with Oracle, Salesforce and Anaplan being Value Index Leaders is a result of their commitment to RPM technology. Vendor rankings for Board, Xactly and SAP were found to meet a broader range of enterprise RPM requirements. Oracle and Salesforce placed higher in Adaptability, Manageability and Reliability with their ease of configuration, breadth of integration with third party data and supporting performance and scalability.

Many organizations will only evaluate capabilities for those in IT or administration, but the Value Index identified the criticality of Usability (20% weighting) across a broader set of usage personas that should participate in RPM.

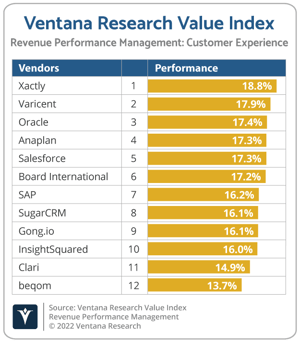

Customer Experience

The importance of a customer relationship with a vendor is essential to the actual success of the products and technology. The advancement of the Customer Experience and the entirety of the journey an organization has with its vendor is critical for ensuring inevitable satisfaction in working with a vendor. Thus, a vendor’s offering is not just about technology and should be evaluated using a lens that ensures the proper assessment and selection of a vendor. Technology providers that have Chief Customer Officers are most likely to have greater investments in the customer relationship and the focus to their success. These leaders also need to take responsibility for ensuring the marketing of their commitment is made abundantly clear on website and in the buying process and customer journey. Our Value Index methodology examines Customer Experience to 20% or one-fifth of the overall Value Index and represents the framework of commitment and value to a customer relationship. The two evaluation categories are Validation (10%) and TCO/ROI (10%) and are weighted to represent their importance to the overall Value Index, balanced with the Product Experience.

The vendors that rank the highest overall in the aggregated and weighted Customer Experience categories and are Value Index Leaders are Xactly, Varicent and Oracle. The leaders in Customer Experience provided an impressive level of information to communicate their commitment and dedication to customer needs for RPM. Vendors such as Anaplan, Salesforce and Board were not Overall Leaders, but have a high level of commitment to Customer Experience as noted by their performance rating.

The vendors that rank the highest overall in the aggregated and weighted Customer Experience categories and are Value Index Leaders are Xactly, Varicent and Oracle. The leaders in Customer Experience provided an impressive level of information to communicate their commitment and dedication to customer needs for RPM. Vendors such as Anaplan, Salesforce and Board were not Overall Leaders, but have a high level of commitment to Customer Experience as noted by their performance rating.

Some vendors have not made Customer Experience a significant priority and provided little to no information through their website, presentations or in our evaluation. Simply providing customer case studies to promote a vendor’s success lacks depth on the commitment to an organizations’ journey to RPM. While the lack of depth can impede a proper evaluation, it does not mean a vendor’s products will not enable RPM. As the commitment to utilizing a vendor is a continuous investment, the importance of supporting customer experience in a holistic evaluation should be included and not underestimated.

Reliability of the Product

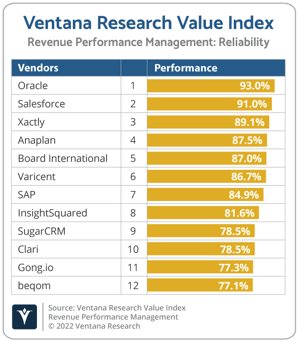

For RPM processes to operate efficiently and for workers to engage the applications, the software on which they run must reliably deliver the necessary performance and scalability using the existing architecture operating across the enterprise and cloud computing environments. The criteria include depth in the performance and scalability of a vendor’s products and architecture, including the metrics to ensure operations and configurability across data, users, instances, activities and tasks. It also examines the investment by the vendor in resources and improvements.

The Value Index for Revenue Performance Management in 2022 weights Reliability at 15% of the overall rating. Oracle, Salesforce and Xactly are the Value Index Leaders in this category, providing the highest level of confidence they can operate at any level of reliability 24 hours a day.

Value Index Leaders in this category, providing the highest level of confidence they can operate at any level of reliability 24 hours a day.

The importance of reliability related to revenue processes is critical as it supports the continuous operations required for business continuity and resilience. Evaluating the performance and scalability readiness of RPM software is not always easy, though, as it depends on the type of RPM processes supported as well as the data volumes and numbers of concurrent users. Some vendors lack the readiness to provide this level of information at any depth that would be necessary to establish the confidence required for a vendor selection.

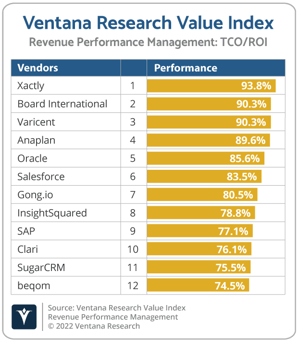

TCO/ROI of the Vendor

The TCO/ROI category applies evaluation criteria designed to assess how effective the vendor is in demonstrating the business case, including the products strategic value, total cost of ownership and total benefit of ownership. The criteria also include an evaluation of the tools and documentation it provides to enable customer evaluation of TCO and ROI, and what the vendor cites as its investment and services to support it. It also examines the investment by the vendor in resources and improvements.

The Value Index for Revenue Performance Management in 2022 weights TCO/ROI at 10% of the overall rating. Xactly, Board and Varicent are Value Index Leaders in this category.

Index Leaders in this category.

A small number of vendors evaluated quite well in this category, providing buyers and customers with TCO/ROI-related support to effectively help with the business case and secure funding for RPM investment. However, our analysis also found that the majority of vendors struggle significantly to make available the tools and documented information to support the assessment needed for organizations to make a sound buying decision. Also, most vendors in the Value Index have limited information on their website to support the survey sections related to TCO/ROI.

Xactly

Company and Product Profile

“Xactly has helped thousands of companies and millions of sellers around the world beat their revenue targets. Using Xactly’s solutions, leaders look past the current quarter to create revenue streams for long-term growth.”

“The Xactly Intelligent Revenue Platform marries artificial intelligence and 16 years of proprietary data in easy-to-use applications. Sentiment, process, and trend analysis come together to form accurate machine forecasts. Quick identification and implementation of revenue plans, quotas, and territory improvements are easy. And, rapid calculation of even the most complex compensation plans keeps sales reps motivated and on track.”

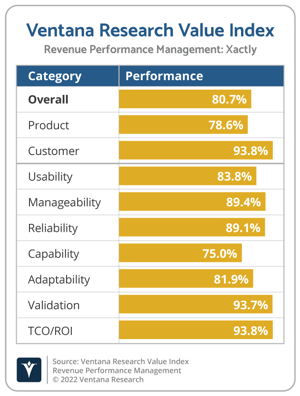

Ventana Research Evaluation

Xactly was categorized as an Exemplary Vendor, ranking third overall in this Value Index evaluation. It ranked fifth in Product Experience where it was designated as a Value Index Leader in Reliability, and fifth in Adaptability, Usability, Manageability and Capability. It ranked first in Customer Experience and was a Value Index Leader in both TCO/ROI and Validation. Its overall performance was impacted by its lower ranking in Capability, which represents 20% of the weighting in the overall Value Index.

designated as a Value Index Leader in Reliability, and fifth in Adaptability, Usability, Manageability and Capability. It ranked first in Customer Experience and was a Value Index Leader in both TCO/ROI and Validation. Its overall performance was impacted by its lower ranking in Capability, which represents 20% of the weighting in the overall Value Index.

Our assessment finds that Xactly could perform better in Capability by focusing on business collaboration and in the areas to share meta data, reports, models, definitions, and application-specific support, and clearly showing the connectivity between its portfolio of products.

Organizations evaluating Xactly should examine the vendor’s solution platform and applications that supports RPM. Xactly actively participated in the evaluation process and request for information for the Value Index.

Appendix: Vendor Inclusion

All vendors that offer products that support RPM and meet the inclusion requirements were invited to actively participate in the Value Index evaluation process at no cost to them. If a vendor did not respond to or declined the invitation, a determination was made whether to include it in our analysis based on our inclusion criteria. These criteria are designed to ensure we include all vendors with geographic operations, customer base and revenue, as well as all relevant aspects of the products’ fit for the particular category being evaluated.

For inclusion in the Ventana Research Revenue Performance Management Value Index for 2022, a vendor must be in good standing financially and ethically, have at least $10 million in annual or projected revenue, operate across at least two countries, and have at least 50 customers. The principal source of the relevant business unit’s revenue must be software-related and there must have been at least one major software release in the last 18 months. The vendor must provide products that support RPM for revenue processes and at least three of the functional areas that should be part of the vendor products: deal and pipeline management, commissions and incentive compensation, contests and rewards, goals and objectives, sales and revenue forecasting, quota and territories, and planning and analytics. These functions should be available on mobile and collaborative channels and should integrate with CRM, SFA, Finance, HR and order systems to support management, operations, analysts and administrators in finance, HR, sales and IT roles.

If a vendor is actively marketing, selling and developing a product as reflected on its website that is within the scope of the Value Index, it is automatically evaluated for inclusion. We have adopted this approach because we view it as our responsibility to assess all relevant vendors whether or not they choose to participate.

Six of the 12 technology vendors (Anaplan, Board, Oracle, Salesforce, Varicent, Xactly) responded positively to our requests for information and provided completed questionnaires and demonstrations to help in our analysis of products supporting RPM. Technology vendors that actively brief and update on their company, product and customer efforts were used as input to the analysis in the Value Index. Online material that was generally available was used for the analysis, along with briefings and any information the vendor did provide. beqom, Clari, Gong.io, InsightSquared, SAP and SugarCRM did not actively participate in the research.

Appendix: Methodology

To prepare this value index, we drew on our research-related work with organizations over the past two decades, which has included benchmarking and advising thousands of organizations. Our continuous market research across revenue performance management provides the context of the real needs of buyers, which was complemented by our research on technology suppliers, knowledge of the market and expertise in this area.

To ensure the accuracy of the information we collect and ensure that the Value Index reflects the concerns of a well-crafted RFP, we require participating vendors to provide evaluation data across all seven categories. Ventana Research then validates the information, first independently through our knowledge base of product information and extensive web-based research, and then in consultation with the vendors.

The Value Index is designed to be independent of the specifics of vendor packaging and pricing. To represent the real-world environment in which businesses operate, we include vendors that offer suites or packages of products since the relevant individual modules or applications must still be evaluated by those responsible for those business processes. We take no position on the offering approach of the products or packages. Where options exist, organizations using the Value Index will need to decide whether they choose a suite of products or individual applications that best meet their requirements.

Here are the major requirements as they were presented to potential participants:

- A vendor could submit as many products as it wished. Each was evaluated to determine individual category compliance as well as ranking in the functionality evaluation.

- Any package of products that was submitted for Value Index consideration also had to be listed on the vendor’s website and be generally available to prospective buyers.

- Vendors were requested to complete a questionnaire detailing the specific functional requirements and capabilities of products submitted.

- Verification of functionality was required through product documentation and/or a demonstration of the actual product.

- Vendors were asked to respond to questions about specific criteria in all seven evaluation categories to provide us with insight into the vendor’s ability to meet specific criteria.

Our knowledge and expertise in the market drawn from continuously assessing vendors and products, our Benchmark Research, a Value Index questionnaire, interviews with each vendor and reviews of the products themselves provided the input for this research. Across the seven categories, each response was assessed, overall analyzed with all information available and reviewed to generating an Index rating. After validation, we aggregated the Index ratings to determine the vendor’s and the product’s placement through a weighted analytic method. If a vendor submitted more than one product for evaluation, we included the product with the best rating in our capability evaluation. The result is the vendor’s best product fit for our criteria.

To arrive at the Agent Management Value Index for a given vendor, we weighted each category to reflect its relative contribution to the value as realized by an organization. We established the weighting of the evaluation categories at the beginning of the process based on our experience and prioritizations derived from our Benchmark Research.

We have made every effort to encompass in this Value Index the functional requirements and capabilities of our research blueprint. Even so, there may be additional areas that affect which vendor and products best fit your particular requirements. Therefore, while this research is complete as it stands, utilizing it in your own organizational context is critical to ensure that products deliver the highest level of support for your projects in this area.

About Ventana Research

Ventana Research is the most authoritative and respected benchmark business technology research and advisory services firm. We provide insight and expert guidance on mainstream and disruptive technologies through a unique set of research-based offerings including Benchmark Research and technology evaluation assessments, education workshops and our research and advisory services, Ventana On-Demand. Our unparalleled understanding of the role of technology in optimizing business processes and performance and our best practices guidance are rooted in our rigorous research-based benchmarking of people, processes, information and technology across business and IT functions in every industry. This Benchmark Research plus our market coverage and in-depth knowledge of hundreds of technology providers means we can deliver education and expertise to our clients to increase the value they derive from technology investments while reducing time, cost and risk.

Ventana Research provides the most comprehensive analyst and research coverage in the industry; business and IT professionals worldwide are members of our community and benefit from Ventana Research’s insights, as do highly regarded media and association partners around the globe. Our views and analyses are distributed daily through blogs and social media channels including Twitter, Facebook and LinkedIn.

To learn how Ventana Research advances the maturity of organizations’ use of information and technology through benchmark research, education and advisory services, visit www.ventanaresearch.com.

What We Offer

Ventana Research provides a variety of customizable services to meet your specific needs including workshops, assessments and advisory services. Our education service, led by analysts with more than 20 years of experience, provides a great starting point to learn about important business and technology topics from compliance to BI to building a strategy and driving adoption of best practices. We also offer tailored Value Index Assessment Services to help you define your strategy, build a business case and connect the business and technology phases of your project. And we provide Ventana On-Demand (VOD) access to our analysts on an as-needed basis to help you keep up with market trends, technologies and best practices.

Everything at Ventana Research begins with our focused research, of which this Value Index is a part. We work with thousands of organizations worldwide, conducting research and analyzing market trends, best practices and technologies to help our clients improve the efficiency and effectiveness of their organizations. Through the Ventana Research community we also provide opportunities for professionals to share challenges, best practices and methodologies. Sign up for Individual membership at https://www.ventanaresearch.com/ to gain access to our weekly insights and learn about upcoming educational and collaboration events, including webinars, conferences and opportunities for social collaboration on the Internet.

We offer the following membership levels for business and IT professionals:

Individual membership:For business and IT professionals interested in full access to our website and analysts for themselves. The membership includes access to our library of hundreds of white papers and research notes, briefings, and telephone or email consulting sessions to provide input and feedback.

Team membership: For business and IT professionals interested in full access to our website and analysts for a five-member team. The membership includes access to our library of hundreds of white papers and research notes, briefings, telephone or email consulting sessions to provide input and feedback, and use of Ventana Research materials for business purposes.

Business membership: For business and IT professionals interested in full access to our website and analysts for their larger team or small business unit. The membership includes access to our library of hundreds of white papers and research notes, briefings, telephone or email consulting sessions to provide input and feedback, use of Ventana Research materials for business purposes, and additional analyst availability.

Business Plus membership: For business and IT professionals interested in full access to our website and analysts for larger numbers of company employees. The membership includes access to our library of hundreds of white papers and research notes, briefings, telephone or email consulting sessions to provide input and feedback, quotes and validation for media, use of Ventana Research materials for business purposes, additional analyst availability, and access to our team for scheduled strategy consulting sessions.

Additional services are available for solution providers, software vendors, consultants and systems integrators.

This Value Index report is one of a series that are available for purchase. Also available are any of our extensive library of Benchmark Research reports. To purchase a report or learn more about Ventana Research services—including workshops, assessments and advice—please contact sales@ventanaresearch.com.

|

© 2022 Ventana Research. Reproduction or distribution of this research in any form without prior written permission is forbidden. The research is based on information obtained from sources believed to be reliable, which can include communications from the technology supplier and information made available publicly on the Internet. Ventana Research is not liable for any inaccuracies in the information supplied. |