Managing Finance More Effectively

Many senior finance executives want their department to play a more strategic role in the management and operations of their company. They believe there is value in shifting their focus from processing transactions to higher-value functions in order to be able to make more substantial contributions to the success of the organization. Continuous accounting can serve as the foundation for transforming the role of the department.

Continuous accounting is an approach to managing the accounting cycle that embraces three major principles:

- Automating mechanical, repetitive accounting processes (such as allocations and reconciliations) in a continuous, end-to-end fashion to improve efficiency, ensure data integrity and enhance visibility into processes

- Distributing workloads continuously over the accounting period (the month, quarter, half-year or year) to eliminate bottlenecks and optimize when tasks are executed

- Establishing a culture of continuous improvement in managing the accounting cycle. Such a culture regularly sets increasingly rigorous objectives, reviews performance to those objectives and makes addressing shortcomings a departmental priority.

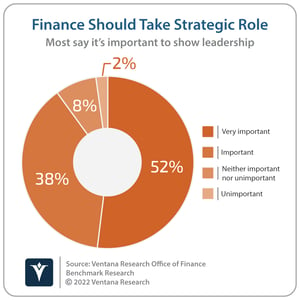

For a strategically focused finance organization, continuous accounting is essential. In our benchmark research on the Office of Finance, nine out of 10 participants said that it is important or very important for finance departments to take a strategic role in running their company. Yet while the vast majority (83%) of companies’ finance departments perform the core functions of accounting, fiscal control, transactions management, financial reporting and internal audit, fewer than half that many—only 41%—play an active role in their company’s management and just 25% have implemented a high degree of automation in their core finance functions and actively promote process and analytical excellence.

In our benchmark research on the Office of Finance, nine out of 10 participants said that it is important or very important for finance departments to take a strategic role in running their company. Yet while the vast majority (83%) of companies’ finance departments perform the core functions of accounting, fiscal control, transactions management, financial reporting and internal audit, fewer than half that many—only 41%—play an active role in their company’s management and just 25% have implemented a high degree of automation in their core finance functions and actively promote process and analytical excellence.

Rather than merely automating existing practices to increase efficiency, continuous accounting recognizes that longstanding processes may no longer be the best approaches. (Many of these practices evolved within the limitations of paper-based systems.) In their place it applies today’s information technology capabilities to establish a foundation on which the finance and accounting organization can build to serve better the needs of a modern corporation. By eliminating the constraints of the traditional, linear record-to-report processes, continuous accounting typically is more responsive, forward-looking and agile than outdated legacy ways of working. Moreover, when used as a concept not only to define and drive but also to explain a department-wide change management initiative, it can facilitate necessary changes in the finance department’s culture.

The Value of Process Automation

Continuous accounting uses software to automate manual tasks, improving efficiency, speeding the completion of processes and, by eliminating human intervention (and therefore the potential for mistakes and misdeeds), enhancing financial control. Continuous, end-to-end process automation is achieved when numbers are entered only once, all calculations and data movements are performed automatically by the system and it manages all workflows. These workflows handle the execution of every step in the same order, enforce approvals and signoffs and control the roles, rules and responsibilities of those involved in performing the work.

Continuous accounting harnesses process automation to deliver multiple benefits to the organization. For one, it improves departmental efficiency. In our research 88% of companies that automate substantially all of their financial close said they complete the close within six business days of the end of the quarter, compared to 59% that automate some of the process and just .png?width=300&name=Ventana_Research_Benchmark_Research_Office_of_Finance_19_19_Automation_Speeds_the_Close_20210513%20(1).png) 40% that have automated little or none of it.

40% that have automated little or none of it.

Continuous automation also enhances financial control and facilitates audit processes by sustaining the integrity of the accounting data. Properly designed, implemented and maintained, fully automated systems serve as a high-level control that can reduce the volume of audit work. In contrast, processes that incorporate manual steps (such as performing calculations, analyses and allocations in a spreadsheet and then entering these amounts back into the system) make it possible for errors and intentional fraud to enter the system.

Another area of benefit is in data integrity—the accuracy and consistency of data stored in a system. Properly configured, end-to-end automation enforces data integrity because the system controls access to the data and process and handles calculations, analyses and process steps consistently and accurately. Such automation eliminates the need to re-enter data by having the system control data handoffs between applications and data stores, thereby ensuring a single, authoritative source of data. This eliminates the need for the extra checks and reconciliations that are necessary when there is no such source of accounting and process-related data.

Automation also can be applied to management of accounting process data to eliminate discrepancies at their source. For example, in booking inter-company transactions, software now makes it possible to ensure that the units, currency values and treatments are consistent between the two entities and their accounting systems when the transaction is booked. It is also possible for software to enforce any necessary reviews and approvals related to different types of transactions.

transactions, software now makes it possible to ensure that the units, currency values and treatments are consistent between the two entities and their accounting systems when the transaction is booked. It is also possible for software to enforce any necessary reviews and approvals related to different types of transactions.

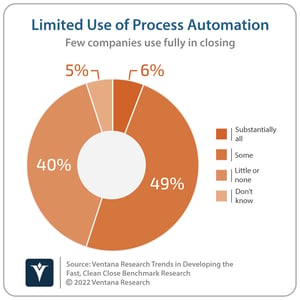

However, few companies have redesigned their accounting processes to take advantage of currently available technology. For example, our research on the financial close shows that only 6% have automated all or most of their close process.

The Spreadsheet Problem

A substantial contributor to the lack of end-to-end automation in finance and accounting is the nature of the tools being used. Our research shows that finance organizations are heavy users of desktop spreadsheets. Spreadsheets are of course essential to many tasks in accounting where they serve as a personal productivity tool for one-off analyses or storing a limited set of data that is not shared with others. However, spreadsheets are not the right choice for repetitive enterprise processes. For example, they are the wrong way to connect the output from one system to another or to manage individual steps within accounting processes. In these cases, desktop spreadsheets are often the root cause of control and efficiency issues in the department because they are incapable of maintaining data integrity.

When an accounting process is diverted from an application into a spreadsheet for analysis or calculations and then re-entered into an application, the break in control makes the system inherently riskier. Even a single break in continuity undermines the data integrity of the entire process. In contrast, software applications used in a properly administered IT environment are far more controllable than desktop spreadsheets, which can be changed and manipulated in ways that are difficult to detect and audit.

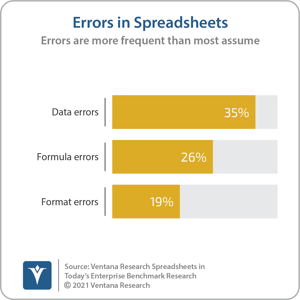

Moreover, our research on 21st century spreadsheets shows that they routinely contain errors: 35% of participants said that they find major data errors in important spreadsheets, 26% that they find major errors in formulas and 19% that they find format errors. Errors pose risks to the integrity of financial statements and create additional work in the department as individuals search for their sources and correct them.

There are straightforward solutions to these kinds of problems. Automating processes from end to end with software designed for the purpose eliminates the need for spreadsheets and other manual systems. It also saves time. Establishing and maintaining data quality and consistency has a measurable impact on the time it takes to close because of the elimination of errors or inconsistencies caused by data issues. More than four out of five (83%) companies that have very significant data quality and consistency issues estimated that they could close their books three or more days sooner if all errors were eliminated. Similarly, using end-to-end automation to ensure data integrity in accounting processes can reduce the time and effort accounting departments spend on mechanical rote tasks such as reconciliations.

the need for spreadsheets and other manual systems. It also saves time. Establishing and maintaining data quality and consistency has a measurable impact on the time it takes to close because of the elimination of errors or inconsistencies caused by data issues. More than four out of five (83%) companies that have very significant data quality and consistency issues estimated that they could close their books three or more days sooner if all errors were eliminated. Similarly, using end-to-end automation to ensure data integrity in accounting processes can reduce the time and effort accounting departments spend on mechanical rote tasks such as reconciliations.

Optimizing Process Management

Automating accounting processes increases flexibility for finance and accounting departments in performing their core functions. Therefore, senior finance executives must examine the ways in which technology-enabled continuous accounting can transform how and when they execute the steps of the accounting cycle to improve departmental efficiency.

Such process changes provide clear benefits. Companies seeking to accelerate the completion of their close process, for example, typically find that distributing tasks over the period rather than waiting until the end to do them enables them to close their books sooner without increasing workloads. Or, by eliminating batch data processing they can run some tasks in parallel rather than having to use their traditional linear record to report sequencing. These sorts of process changes usually are not complicated and can be implemented easily.

While many organizations may consider their current processes to be immutable, the typical monthly, quarterly and semiannual cadences of the accounting cycle are not set in stone. In fact, much of what we think of as “normal” bookkeeping and accounting procedures is rooted in centuries-old limitations imposed by paper-based systems and manual calculations.

For instance, the common periodic processes of the accounting cycle (performed, say, monthly or quarterly) developed as the best approach to organizing, coordinating and executing the calculations needed to sum up the debits and credits in journals and ledgers. The cadences of these manual systems represent a trade-off, balancing efficiency and control. Their timing is the result of having to wait for sufficient volume of entries to justify taking the time to perform manual summations, adjustments and consolidations, while not waiting so long as to jeopardize financial control.

Early computer-based accounting systems increased efficiency, mostly by automating calculations. However, technology limitations and constraints imposed by their design required these tools to perform work in a batch rather than continuous mode. These limitations prohibited changes to those paper-based cadences and constrained the scope of continuous accounting processes.

Only recently has technology reached a threshold at which it can support a transformation of core finance and accounting processes so companies can easily schedule the timing of their accounting cycle tasks to distribute workloads across the period and continually monitor actionable information. For example, reconciliations that were done only at the end of the month now can be performed daily, weekly or biweekly. Likewise, account balances can be monitored in real time.

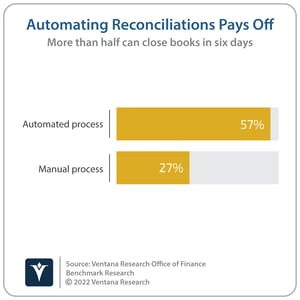

This increased flexibility enables CFOs and controllers to re-evaluate how best to schedule and organize work related to the accounting cycle. So far, however, not many have taken advantage of these opportunities, to their detriment. Our research on the Office of Finance finds, for example, that 57% of companies that have automated their reconciliations process are able to complete their quarterly close within six business days compared to 27% that have not. But only 37% of companies use software to automate their reconciliations process.

not many have taken advantage of these opportunities, to their detriment. Our research on the Office of Finance finds, for example, that 57% of companies that have automated their reconciliations process are able to complete their quarterly close within six business days compared to 27% that have not. But only 37% of companies use software to automate their reconciliations process.

By exploiting the capabilities of information technology, accounting process automation gives finance departments the freedom to use a continuous accounting approach to restructure how and when they perform individual accounting cycle tasks.

The Path to Continuous Improvement

Establishing continuous accounting is not just a matter of process and technology; it also requires a conscious strategy. As an approach to business process management, continuous improvement involves ongoing assessments of an organization’s processes and the regular implementation of changes to improve their efficiency or effectiveness. The success of Japanese manufacturers that adopted a continuous improvement management style led companies worldwide to embrace this technique in the last third of the 20th century.

Continuous improvement is just as applicable to the accounting function as it is to manufacturing operations. After all, the finance organization is essentially a numbers factory. Transactions and other data enter its systems and, after processing, result in financial statements, budgets, reports and analyses as outputs.

Continuous improvement works best in the situation most finance and accounting organizations commonly find themselves in: having to address a series of small issues rather than a single big one to achieve better results. For example, in our research companies that have succeeded in shortening their close process most often (71%) said that the source of the improvement was controlling the details of the process more consistently and effectively.

A continuous improvement approach recognizes that business is not static. As conditions change it’s necessary to adapt and modify processes, policies, procedures and even people’s behavior. Yet here again our research finds that only a minority of finance and accounting departments make regular, frequent assessments of their core processes. For example, just one in three (33%) companies said they review their close and treasury management processes on a monthly basis.

procedures and even people’s behavior. Yet here again our research finds that only a minority of finance and accounting departments make regular, frequent assessments of their core processes. For example, just one in three (33%) companies said they review their close and treasury management processes on a monthly basis.

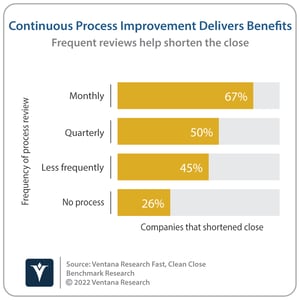

Nevertheless, our research finds a correlation between frequency of process reviews and achievement of better results: 67% of companies that review their close process monthly said they were able to shorten their close, compared to 50% that review quarterly and just 10% that review annually.

Creating a Strategic Finance Department

Implementing a continuous accounting program does not have to be a monumental task; it can be accomplished step-by-step. But it does require methodically addressing the often-interconnected issues of people, processes, information and technology. For example, one initial step should be to review of each of the subledgers to determine which of them could be posted daily, weekly or on an ad hoc basis to balance workloads away from the end of the month. Leadership and communication are essential to implementing change since finance and accounting departments have a culture of adhering to fixed rules. As with any type of change management initiative, it requires a high degree of ongoing involvement by the CFO, the controller and the head of accounting.

It is also important that executives recognize the direct connection between how well the department manages the minutiae of core accounting and finance processes and their ability to achieve strategic objectives. Such linkages are seldom obvious. Although there’s some connection between these two extremes in other parts of the organization, managing minutiae is the essence of what finance departments do. So, it is essential that senior executives understand the positive impact of having an overarching approach to addressing the “little stuff” (such as using end-to-end data management) embedded in their systems and processes.

All major processes must be re-examined, rationalized and improved where necessary. Finance organizations also must perform a thorough examination of their department’s software to determine how well the applications support a continuous accounting environment. Where gaps exist between current capabilities, Finance must assess new software and improved data management techniques that can address those gaps. Those doing the assessment then should prioritize replacing systems according to which changes can achieve the most improvement.

Continuous accounting is an essential discipline for finance organizations that want to play a more central and strategic role in their company. It provides a foundation for finance transformation and thus can separate innovative organizations and leaders from those content with the status quo.

About Ventana Research

Ventana Research is the most authoritative and respected benchmark business technology research and advisory services firm. We provide insight and expert guidance on mainstream and disruptive technologies through a unique set of research-based offerings including benchmark research and technology evaluation assessments, education workshops and our research and advisory services, Ventana On-Demand. Our unparalleled understanding of the role of technology in optimizing business processes and performance and our best practices guidance are rooted in our rigorous research-based benchmarking of people, processes, information and technology across business and IT functions in every industry. This benchmark research plus our market coverage and in-depth knowledge of hundreds of technology providers means we can deliver education and expertise to our clients to increase the value they derive from technology investments while reducing time, cost and risk.

Ventana Research provides the most comprehensive analyst and research coverage in the industry; business and IT professionals worldwide are members of our community and benefit from Ventana Research’s insights, as do highly regarded media and association partners around the globe. Our views and analyses are distributed daily through blogs and social media channels including Twitter, Facebook, and LinkedIn.

To learn how Ventana Research advances the maturity of organizations’ use of information and technology through benchmark research, education and advisory services, visit www.ventanaresearch.com.